The LoA Pain

The Letter of Authority (LoA) process is a major pain point wasting over £442million every year. For advisers, it’s time-consuming, requires manual input, and providers, platforms, and schemes have varying submission methods, forms and signature requirements, often leading to client frustration.

The Solution: LoA 2.0

A single digital platform to submit, track, and manage all LoAs, including paper forms, across pensions, investments, and protection products from all providers.

Sophisticated AI for LoA extraction

LoA 2.0 leverages sophisticated AI to eliminate errors and manual data entry by automatically extracting information from returned LoAs.

One Signature, Lots of LoAs

LoA 2.0 provides a compliant digital signature tool, eliminating the cost and hassle of collecting multiple wet signatures by enabling a single, secure and authenticated signature for multiple LoAs.

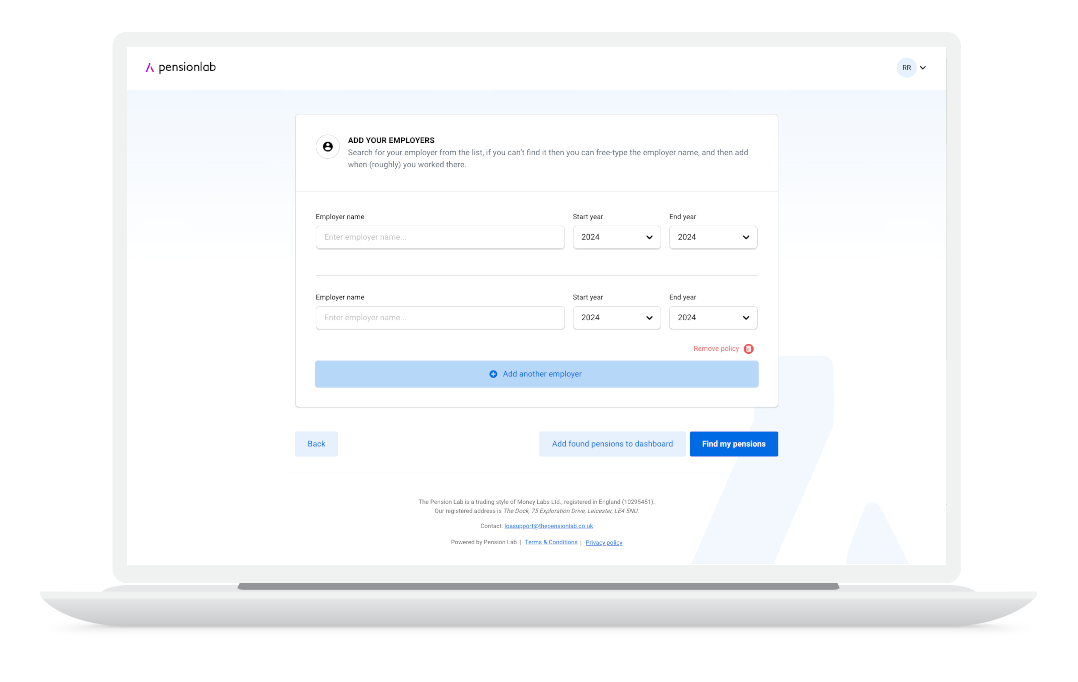

Automated Pension Finding

LoA 2.0 enables access to the leading pension finder tool to significantly reduce the time spent locating pensions.

Reduce client onboarding timescales by 80%.

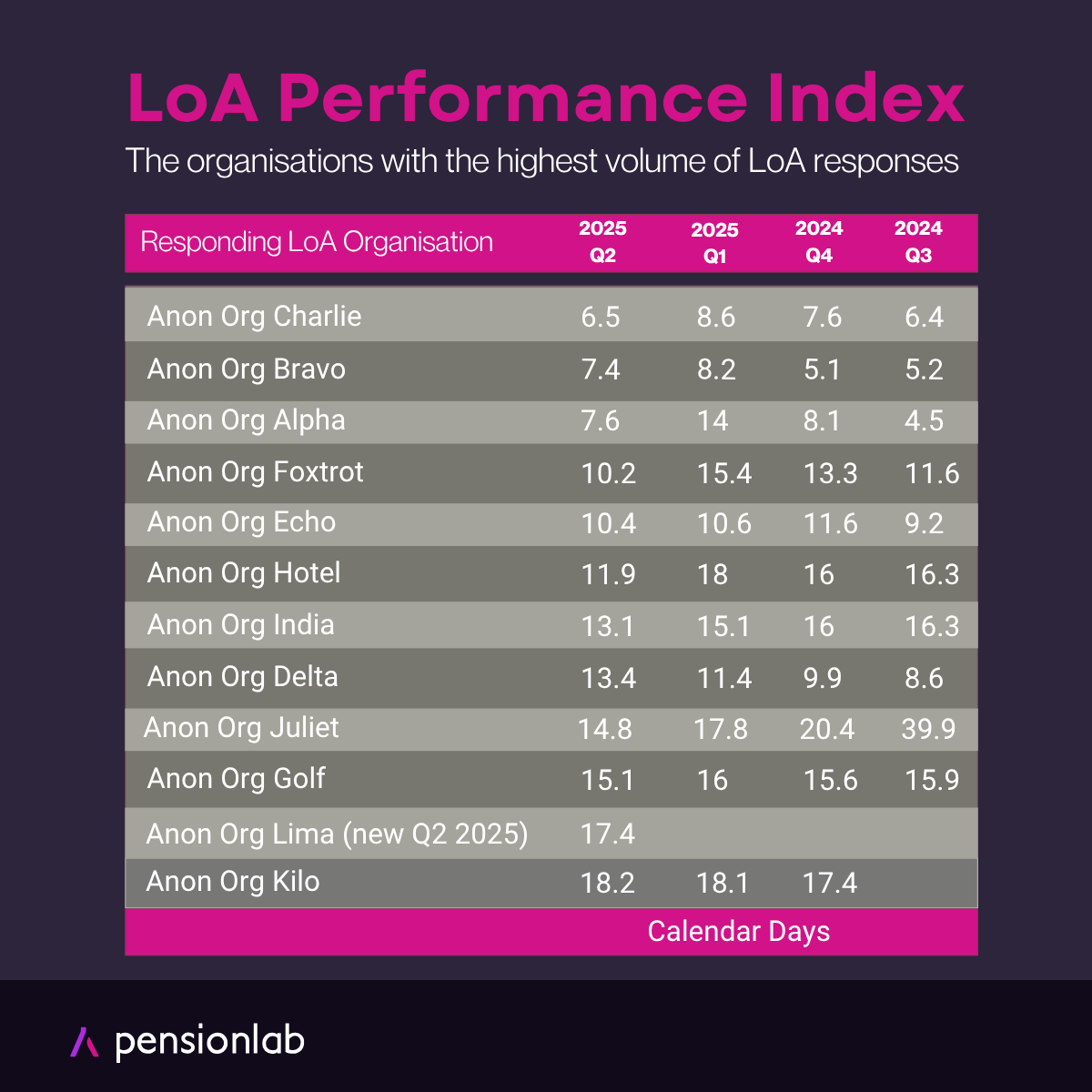

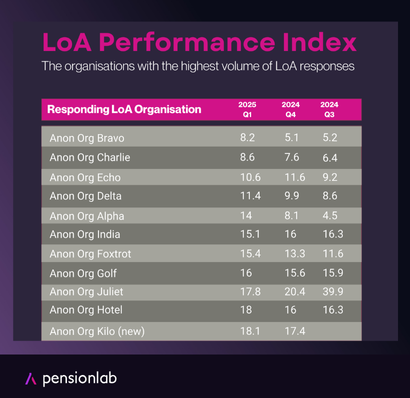

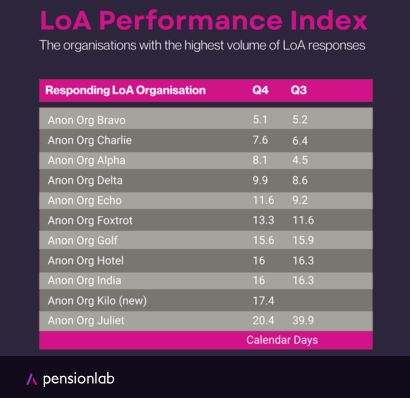

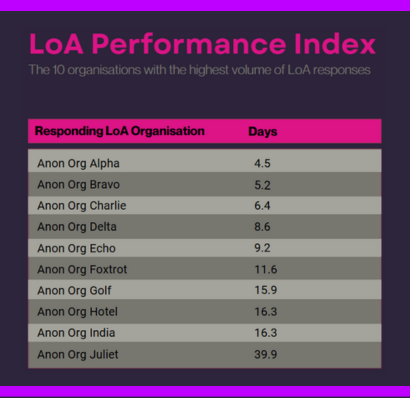

LoA 2.0 automates the chasing of LoAs and provides real-time tracking with accurate performance timelines based on our comprehensive LoA ecosystem and powerful algorithms.

LoA services are ideal for…

- Financial Advisers

- Digital or hybrid advice solutions

- Pension companies

- Fintechs

Ways to connect:

Just ask our clients.

Don't take our word for it!

"Through agile application of technology and with an ongoing focus on solutions, The Pension Lab has supported Smart in delivering on a key initiative to optimise the pension consolidation experience"

"As a specialist pension administrator, it is important that we offer a wide range of solutions for pension schemes to consume. The Pension Lab helped us to deliver on this objective through the deployment of a highly effective and frictionless end-to-end consolidation journey, from pension finding through to a robust paper free transfer process"

"Working with The Pension Lab has enabled us to offer our members a superior pension dashboard and consolidation experience, allowing them to easily track, trace and transfer prior pension pots. We've been impressed with The Pension Labs consistent approach to product improvement and with the results achieved"

"The time taken from the customer receiving their LoA to completed policy details has reduced by 78%... And we're spending 80% less internal time on this process."

"The Pension Lab LoA service has been a gamechanger, it has removed all paper handling from the LoA process and enables our Planners to get the information they need to help our clients."

"Got it all back in 4 days and only took 3 minutes of my time to do. I wouldn’t have even found the form in that time!"

"It has significantly streamlined the LoA process, making it far more efficient and saving us a substantial amount of time."

Leading the Letter of Authority Evolution.

We’re passionate about improving the often-painful process of LoAs and recognise that it needs a collaborative industry effort to make it more streamlined. This dedication has led us to spearhead the #LogYourLoAPain campaign, author the "What Lies Beneath Letters of Authority" research and white paper, and establish the Fix LoA Action Group (FLAG). Supported by research and representatives from all LoA stakeholders across the industry, FLAG strives for actionable improvements to the LoA process.

Aberdeen is the latest platform to accept Pension Lab’s eIDAS qualified signatures for Letters of Authority

Blog

Aegon Master Trust to introduce pension tracing and consolidation service for employers

News article

Pension Lab bolsters team with senior hires, appointing ex-Moneyhub director to spearhead next phase of growth

News article